The “Big Four” Dominate

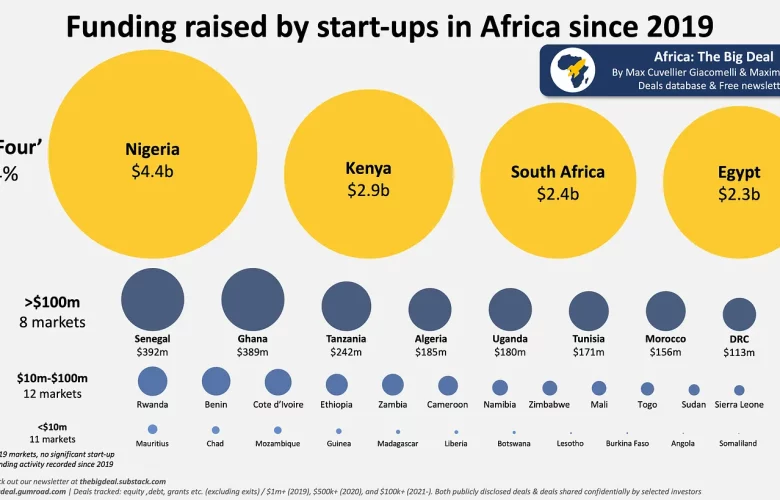

The report highlights the dominance of a select group of countries: Nigeria, Kenya, South Africa, and Egypt. Collectively known as the “Big Four,” they have attracted a staggering 84% of all funding since 2019.

Nigeria stands out as the continent’s investment leader, grabbing a 30% share of the total capital. Following closely are Kenya ($2.9 billion), South Africa ($2.4 billion), and Egypt ($2.3 billion).

Beyond the Big Four

While the Big Four reign supreme, other African countries are not entirely left out. Senegal and Ghana have emerged as the next most attractive destinations for investors, though their funding figures pale in comparison to Egypt’s. Interestingly, Ghana boasts a more diversified funding landscape, with investments spread across various startups. In contrast, Senegal’s funding is heavily concentrated in a single company, Wave, which has received a staggering 76% of the country’s startup funding since 2019.

Emerging Markets Show Promise

Beyond the established players, a new wave of markets is attracting investor attention. Countries in East Africa (Tanzania, Uganda) and North Africa (Algeria, Tunisia, and Morocco) have all seen startups raise over $100 million since 2019, with the Democratic Republic of the Congo being the sole exception.

The Funding Gap

While there’s a positive trend across the continent, a significant funding gap remains. Twelve countries have secured between $10 million and $100 million in investments over the past five years, and an additional eleven have attracted less than $10 million. The remaining nineteen markets have yet to see substantial funding activity, often receiving less than $100,000.

The African startup ecosystem is undoubtedly thriving, with a significant increase in funding. However, the distribution of this capital is uneven, with a clear concentration in the “Big Four” and limited activity in many other markets. As the continent moves forward, fostering a more balanced investment landscape will be crucial for nurturing innovation and ensuring widespread growth across Africa’s entrepreneurial spirit.